| Sarah Koss VP, Account Services |

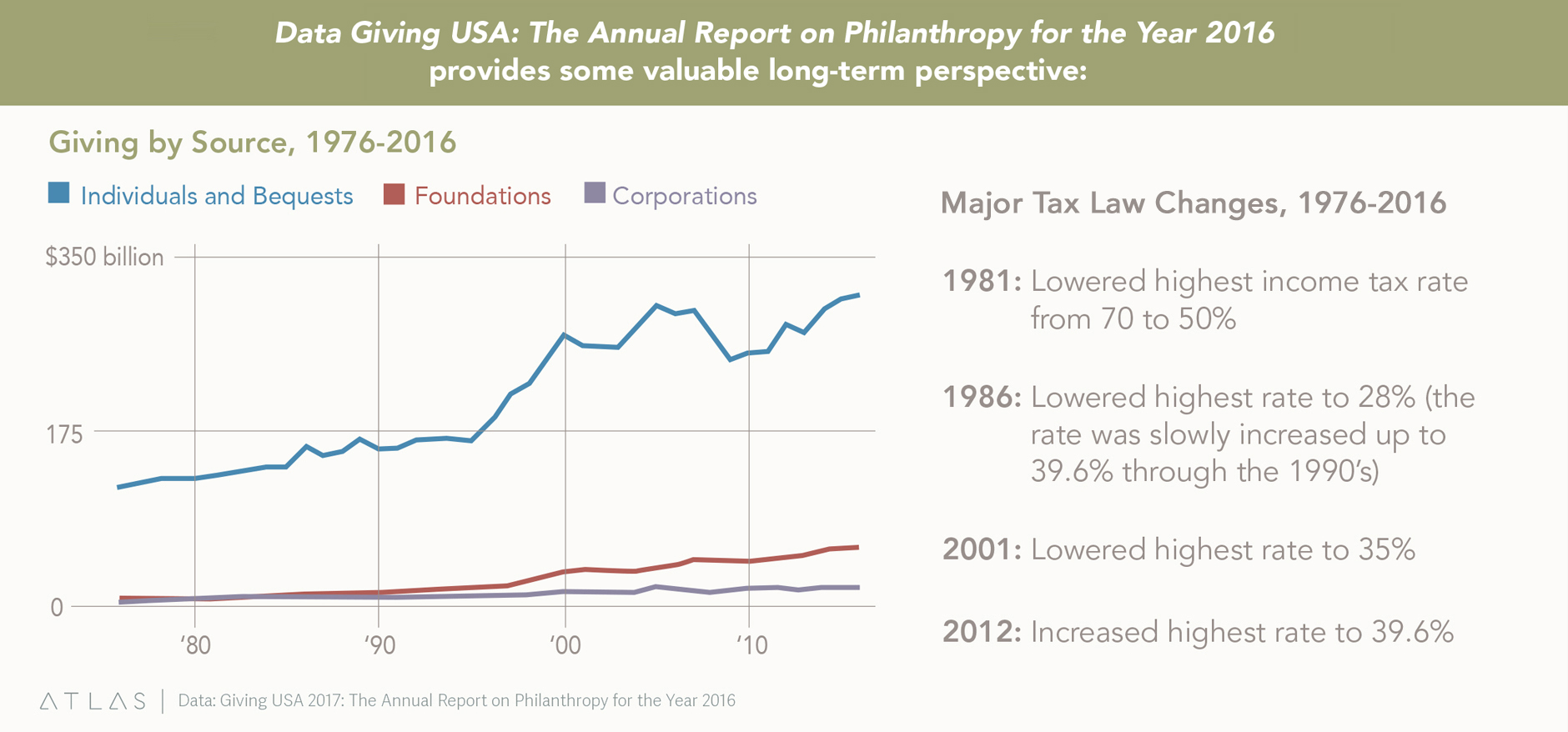

We all know that getting the second gift from a new donor is a key objective in the donor journey and crucial to long-term retention. And yet, as many as 70% of all donors leave us after that first gift. How can we enhance & extend the donor journey to reverse the trend?